We’re so pleased to be partnering with our sponsor Capital One to help celebrate National Consumer Protection Week. We’ll be sharing cool, smart surfing tips on how to keep you and your family’s online privacy as safe as you can.

Now we love social networks, internet surfing and web shopping as much as the next mom, but as more of our time is spent in the cloud, we’re increasingly concerned about the information we’re sharing and how to protect our privacy. Lately, it’s been hard to tell what’s legit and what’s a big fat scam, and with our kids entering the online world too, it’s more important than ever to make sure we’ve got our personal information under a virtual lock and key.

We’ve put together 5 smart tips to help you keep your information private, especially if you’ve got kids in the house.

1. Keep an eye on those Facebook settings

We’ve written about it before and we’ll say it again–be sure to check your Facebook privacy settings on a regular basis. With so many frequent updates, it can be difficult to keep up with who’s seeing what. In other words, just because you’ve got “private” checked, it doesn’t necessarily mean your info is on lockdown. Be sure to take a few minutes every week or so to flip through your profile to make sure you’re not sharing your phone number and all your embarrassing high school photos with more than just your “friends.”

2. Learn about cookies. The no calorie kind.

Cookies are little bits of info that get stored on your computer from various websites–stuff like passwords, preferences, or your shopping cart. (Yay shopping carts!) They’re actually a good thing, and save you time when you return to favorite sites. But if you want to be sure they’re only being used by trusted sites, and not by less scrupulous folks, you want to enable cookie alerts through your browser. In addition, you can arrange your settings so the cookies are only stored for a limited time.

You can also be sure your info is safe and encrypted when there’s an https:// at the beginning of a website URL–probably what you’re used to seeing when you do online banking.

3. Going phishing

It seems that phishing scams are on the uptick these days, and even the most savvy of online users can be fooled by sophisticated but fraudulent emails or websites that want access to your personal info. If an email or website asks you to share personal information (including account, social security, or birthdate) as part of a survey, delete immediately. You can also use SurveyPolice.com to help check on the legitimacy of any website. Plus you can report phishing scams to most financial institutions and large ecommerce sites to help them shut them down.

4. Give a second thought to public Wi-Fi.

A recent New York Times article confirmed that public Wi-Fi makes it super easy for your personal information to be hacked. Yikes. Check your favorite blogs if you must (hello!) from the coffee shop, but it might be best to wait until you get home to check your bank account status or make purchases. If you have to check email or log in to any accounts, your best bet is to be sure to log out when you’re done. That latte and quick internet check shouldn’t cost you thousands of dollars.

5. Start talking to your kids about this stuff. Early.

Even if your kids are just hopping on the Internet to play educational games under strict supervision, it’s important that they understand the basic rules of safe Internet navigation, the same way they understand the basic rules of strangers on the street. Make sure it’s clear that they never share any type of personal information with anyone, and if they’re uncomfortable or unsure about a particular situation, they should come get you immediately. It’s never too soon to have a conversation about safety, online or off.

For more helpful tips, make sure to visit the very helpful National Consumer Protection Week website and check our sponsor Capital One and their helpful ID Theft and Fraud Prevention guide they’ve created with national consumer advocacy group Consumer Action. And follow them on Twitter where they focus on providing helpful financial education for families.

For more helpful tips, make sure to visit the very helpful National Consumer Protection Week website and check our sponsor Capital One and their helpful ID Theft and Fraud Prevention guide they’ve created with national consumer advocacy group Consumer Action. And follow them on Twitter where they focus on providing helpful financial education for families.

[photo courtesy of Shutter Sisters]

I like using paypal so that you can limit the number of sites you must provide your credit card info to.

Tips:

Check your child’s history log to see where they have been online.

Talk with your child about what they are doing online and how to be safe.

Facebook requests users to be at least 13. I agree!

If your child has facebook, make sure you are on their friend list and check it often.

While I pay bills online and buy lots of things via the internet, I don’t access checking account online.

Blocking my mom on Facebook was the best form of privacy ever.

Setting Google alerts for your name and your kids’ names and your blog name is a good way to be aware of what’s floating around the interwebz.

Password protect your wifi at home. No matter how silly it seams, there are always people out there who want to use your connection. Can bog down your speeds and even access your personal info or print to your shared printers

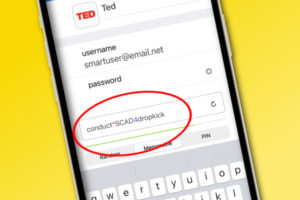

One tip I have learned about helping with internet safety and privacy is to make my password as unique and possible. I’ve had my email hacked into before, so I now use very strong passwords, with a combination of upper and lower case letters, numbers, and special characters as much as possible when websites allow it.

If you have teenagers the best tip I can share is to keep up with current technology and ‘cool’ websites such as twitter and tumblr. I frequently use gizmodo.com to help keep me up to date.

My kids are older, and they know the basic rules of Internet safety, but they aren’t allowed to use any application/website until I know how to use it first.

Additionally, I have to be able to get into their accounts at all time, or they may no longer have that account.

An easy tip I learned was to have a set of passwords for work and home. Thanks for sharing!

To protect my family, I keep my personal information disconnected from my social networking as much as is possible. My (personal) facebook account is not connected to anyone that I don’t know personally, have not met in person. All my social networking is done under a psuedonym.

My advice: Be aware. Use these tips to help you be aware of what you are putting into the public space. And please let me win the iPad!!!

I love staying connected on Facebook, but I never play games or any applications that ask for access to your account, especially if someone sends them to me. Too many outside sources having access to your Facebook information is not a good thing.

My tip is for parents to keep their computers in a public place in the house. Thanks!

I periodically do a Google search on myself to see what comes up. Then if I feel like too much is visible, I make changes as I can on the links that are displayed. Also, you can search for yourself on http://www.spokeo.com, and click on “Privacy” at the bottom and remove any and all info that might be visible to searchers.

I also do google searches, but for my children as well. I found my oldest daughter listed on a few of those sites that link family members with pay for personal information. They were very prompt in taking down her name when I requested it. Only problem is, I have no idea how her info became public record (other than birth obviously).

My 5-year-old, who is just learning to read, loves to play games online, but we’re struggling with how to keep him safe. He’ll click on things because he doesn’t know what they are. For now, I’m trying to teach him that if any windows pop up, to click the red “x” and close them right away. We’re working on the always ask an adult before you click on something rule, but he hasn’t quite gotten that one yet.

I use multiple email addresses to help filter my private vs public emails.

I’ve made checking ALL of my credit and banking accounts part of my daily routine. There have been times when I’ve caught stuff before it had a chance to post!

Spokeo is a great site that shows all sorts of pubic info about us. I make sure that I am “private” on there, and also keep all of my info on Facebook as private as possible. This is an ongoing process, since FB is always changing things!

I keep my facebook photos and information locked to “friends only” and I often unfriend or decline friend requests to keep it more personal. It creeps me out that a stranger who is a friend of a friend of a friend could see my photos.

I use google, snopes and Symantec’s database to check on things I’m suspicious of.

Unless I’m shopping or researching, I use inPrivate browsing. I also change my passwords regularly.

The Google search is a great idea. I discovered several of my relatives had their full name, birthdate, and social security numbers readily available on a geneology website just recently!!! I also recommend really reading the fine print for any websites, newsletters, contests, ect, one signs up for – I’ve had my information passed along on more than one occasion, receiving both phone calls and post.

megancrose at gmail dot com

I have a separate email address for all my online shopping, commenting, etc. My ‘real’ email I only use for my personal emails. Don’t know how much this helps but it does keep my email box clean!

I use LastPass to generate and keep track of unique and secure passwords for ever website I log into that contains sensitive information. It’s so convenient because I don’t have to remember so many different, complex passwords!

If inputting any sort of payment information or other secure info, I always make sure the URL beings with https, not http.

I always watch the URL bar when clicking on a link from email that seems legit, but might not be– despite what the page looks like, you can tell a lot from what the actual URL is, and if it’s fake, it’s never what was listed in the email.

I use a separate mailbox address instead of my home address for anything that I do online.

We use one credit card for purchases over the Internet only and it’s one that is NOT linked to our bank account. This way we are able to see immediately if there was an unauthorized charge etc. plus the credit card companies are really good about catching strange purchases on your card and give you a call.

I re-check my FB settings every month and my husband runs software every month to check for bugs.

Never open e-mails when you do not know who they are from.

Definitely change your passwords periodically.

I use numbers for letters in my passwords when possible. For example. A=4 and S=5.

Make sure to be on a secure site when spending your money on line look for an “s” after the http in the begging ofthe wedsite address. Example: https

we have our own personal hotspot (mingo wireless) that we take with us on the go, so we don’t have to use free wifi and compromise our security.

Our family computer is in a spot where I can see the screen so that I can see what my boys are getting into.

I always type in and/or search websites independently. I don’t rely on “clickable” links to get to the pages I’m interested in. I read once that scammers can set-up look-a-like sites to fraud customers into revealing their password, login or other personal information.

I taught my children to never enter any of their real information into a computer. That includes school, sports teams and anything that could be used as identity markers such as player #’s/

Always log out of any page.

i carefully select which companies i will give my email address to, and which blogs i will post on- of course cool mom picks is allowed! it is scary what is available on the web, even when you think you are being careful! what what you put out there, and careful posting on FB anything you don’t want someone to find and use to harm you.

Of course I keep the list of accts and passwords at home but I also try and go in at least every six months and change the important ones (financial, etc.) I use the daylight saving times change as my prompt.

When creating new passwords, consider making up your own acronym out of a sentence that’s meaningful to you. Plus, add punctuation. So, for example, your password might be CMPisB! (Cool Mom Picks is the Best!).

I’ve stopped sharing a lot of info and pics on facebook. I never post status about trips until after we’re back if @ all. I’m also more aware of the backgrounds of the pics I post online. Yes Grandma may notice the sweet little child’s face but the person browsing someone else’s facebook may be too concerned with “taking” in the big screen or jewelry box off to the side. Too many people have access to that info. We are responsible for what we put out there. Be AWARE people!

I use different passwords for all of the different sites and retailers that I use.

Change your passwords frequently and set up a separate e-mail for “junk” mail.

I use a good all around virus/anti-malware software, Vipre, that is not expensive but is a great protection!

Everytime I pay w. cc on a website, i remove my account info right afterwards

We’ve started using 1password. It’s really nice, because it makes it super easy to have really great passwords for every site you might ever enter sensitive info, without having to somehow remember all those crazy passwords!

I also am big on those more secure facebook settings, and have different friends lists so that only my actual friends (rather than all those randoms from high school!) can look at my pictures and read any personal info.

I enjoy shopping on Ebay and other deal sites, but am often concerned about the privacy of my bank information. I am thrilled that most legit sites will accept Paypal as a legitimate form of payment, which keeps all of my info safe and secure.

I have my Facebook profile set so it won’t come up in a Google search. And I don’t accept invitations for things like Lil’ Green Patch and other Facebook games/apps that my friends want me to play.

Before I enter in personal info or payment info to a site I always check the URL to make sure that it is a secure page (https, SSL, etc).

Always learn more about the party you are buying from online before making giving personnel info.

use paypal not a credit or debit card

I always make sure the web address says https at the top if I am going to transmit credit card or other sensitive information over the web. If not, I find what I need on another site that is secure.

My husband and I have a credit card account that we use only for all of our purchases on the Internet. That way it is easy to scan each month’s list of charges to check for and fraudulent activity, and if we do have to cancel the card it won’t affect automatic bill payments that we have set up using another account. We researched and found one with the best rules regarding fraud.

I always use my paypal credit card to buy things with. I am protected better that way..

itsjustme62613 at gmail.com

I pay bills online but use a credit card instead of my bank account info. Also only do this from home.

I have my FB privacy settings at their most restrictive, and even then I don’t post pictures that I wouldn’t want a future employer (or my children’s future employers) to see. Our family photos are on our own site, behind a password.

Minimize the number of sites you are subscribed to and provide info to. I also try to use paypal as often as possible.

I never check the “remember this credit card” box on websites anymore so that my credit card information isn’t as easily available to hackers.

I’m very select when I make purchases on the internet. I make sure to use a credit card, that we only have a minimal credit line on and I check that credit card for charges regulary. I also make sure that the sites I order from are locked sites.

Thanks so much.

rickpeggysmith(at)aol(dot)com

Use Paypal instead of entering in credit card info.

It said my previous entry failed…darnit! I keep 2 separate facebook accounts – one for entering contests and giveaways, one for close friends and family. I frequently check the privacy settings for the personal account – and I will be checking my daughter’s as she gets older, too! She is only 3 right now, so I have a few years to worry about it.

safeeyes software – good reviews

being a diligent parent – no cell phone in rooms for night texting/surfing

tvollowitz at aol dot com

I try to use my Facebook groups to make sure that only the people I want to see my son’s pictures do.

Set up a credit card or bank account with limited funds that is only used for internet transactions and is not linked to your regular banking information.

I have a separate email account that I use for plugging in to any site online. It helps keep my spam tied to a separate account & my personal account….personal.

all of these comments are really great – and helpful! i’ve already learned so much just skimming them. my suggestion is not that creative – i haven’t posted very much info about my kids online, other than emailing their pics from time to time, or uploading them to a password protected sharing site (me.com).

It looks like even they can’t keep up to date, but I do like the facebook scanner at https://www.reclaimprivacy.org/ .

Have personal home network secured with a really long, *random* password. My dad learned this the hard way when someone hacked his password (his occupation). Changing it once in a while doesn’t hurt either.

If you use twitter on your smart phones, be sure to pay attention to the settings when setting it up. I found out my location was being broadcasted with every tweet.

Thanks for the opportunity to win!!! I’ve been so wanting an iPad!!!

My kids are so young at this point its hard to have to think about the Internet as they grow older… but already the 3 1/2 year old can navigate my iPhone to any game she wants so its going to be real quick.

Recently another mom told me she has a rule – in exchange for paying for the kid’s cell phone (smart phone) – she can read all the texts/emails whenever she wants.

Another dad told me that all email his daughter receives is cc’d to his wife. (Through Mobile Me)

Also have heard of new service.. myI … that uses apps to control the Internet in your house. So you can have wifi automatically turn off at a certain time.

Not looking forward to dealing with all this when my kids grow up. Next year. Yikes!

Setting all my facebook settings to only friends has been a help.

When not paying through Paypal, I use a credit card versus a debit card. If there’s an issue with the vendor, it’s a lot easier to dispute the charges and change the account number than if you’d used your debit card.

My tip is to ‘regularly’ change your user passwords!

Also, when creating new passwords, make them as ‘unique’ as possible; perhaps using one of your ‘favorite phrases’, instead of using just numbers and letters!

Thanks for the great giveaway offering!

I would love to WIN this 16GB iPad 2!

Good Luck to All!

I learned the hard way by having email & eBay accounts hacked to make your passwords as strong as possible – use a combo of upper/lowercase letters, numbers, punctuation.

Do not store credit card numbers on your computer.

Be intentional about the pictures that are put online. It’s easy to get carried away with putting up cute pictures of my son, but it’s easy to forget that all kinds of information is being put up about our family with each picture.

Thanks!!

I like to use the pay as you go credit cards on online purchases.

ftc.gov has lots of good tips.

I like to use PayPal when shopping online. I appreciate that I don’t have to enter my information at all the different sites I might buy from.

I admit I just don’t know enough about keeping my info safe. I do try to change out my passwords often, and don’t use the same password for everything (which is very hard when I am so tired and have no memory.)

Steph

I always have my spam guard and anti virus on whenever I go online because I don’t want any viruses to get on my computer.

When I do any banking online I make sure the site is safe by checking the secure link at the bottom of my page.

I go to spokeo and type in either my name or email address and if anything shows up with my personal information, I contact the company to take it straight off!

When I purchase things online through ebay I go through paypal and it makes my transactions secure.

We keep the kids’ computer in the family room.

I am ensuring my children’s personal privacy by not allowing them to use the computer. I am proud that my 5 year old doesn’t know what the internet is.

I make sure that my settings for facebook, etc are as strong as they can be.

iPad 2 Please pick me!!!!!

I use paypal as much as possible and never save credit cards on shopping sites.

I use one email address just for stuff that could create junk mail or for times I don’t want to risk spam….

I use complex passwords with letters numbers & symbols…

I keep our wireless internet secure…

I keep computer privacy settlings at medium

Wooo hoo ipad 2

I use PayPal whenever possible to pay for purchases online because credit card information is never shared.

kport207 at gmail dot com

Think twice before entering the same password for banking or credit cards anywhere else. Create unique passwords.

ky2here at msn dot com

As a victim of identity theft, I recommend using one computer for banking and another one for everything else. That way you never have to worry about phishing email getting your banking info.

I keep my security settings at the highest level and keep our computers in common areas of the house so that our kids are in full view when on the computer.

Never give too much personal info away online. There may be more eyes watching than you think!

I dont pay bills online with bank info.

I limit who can see my pictures, status updates etc. And have a blog for more intimate/private stuff that’s invite only!

I always log off of sites when I’m done. Even fb. I left that logged on once and got hacked. I can only imagine what would happen if I left something more important logged on.

Our wireless router is not only password protected but it is “hidden” so it doesn’t even show up as being an available network. No one can use our wireless without our knowledge. We have to allow the device in order for it to connect. Once we have done that though, it is all set.

I have seperate passwords for online banking, kids passwords, school passwords and work passwords.

Scott Martin

spmartin122@gmail.com

Be careful where you post your pictures. A friend of mine had some crazy man download the pictures of her daughter from her public facebook page (she’s a photographer) and create a facebook page with her daughter’s name using those photos. Freaky!

Facebook did work with her and was very responsive to shut the page down.

Never use the same passwords on your accounts. I keep an address book to write them all down in.

I check history frequently. Kids don’t usually think to empty that.

I don’t keep any of my credit card numbers on file at any site. Hackers are everywhere!

The biggest threat kids will face online will be their peers — make sure to check in on your kids to know whether or not they are being bullied, or bullying, as that is a much greater risk than a sexual predator.

I try to use paypal as much as i can.

I make sure to keep my virus software up to date. Doing that has definitely helped me catch some doozies that could have done major damage to my system and files.

I never put pictures of my kids on public forums or websites, only on my privacy protected facebook. There are a lot of people out there who will take your kid’s pictures and call them their own (or do worse things with them!).

I’ve been using Zoobuh for my daughter’s email. I am happy to have found a service that allows me to closely monitor and control her email access.

I use an ad blocker to keep innocent eyes away from all the popup garbage.

Dove056 at aol dot com

Check that websites start with https. It is secure then.

As a elem. tech teacher, I create shortcuts on the student server to safe internet sites like pbskids and skillbuilder.com As a mom you can create a folder on your home computer for the shortcuts.

BTW, thanks for the chance to win an ipad! My dream tech tool! I want to use the chore app you posted earlier!

I change my passwords frequently and always make sure they are strong (numbers, symbols, letters- uppercase and lowercase).

I delete cookies and history every week, and I check both to keep an eye on my teenage boys…gotta keep them safe!

I try to change my password often, and only shop on sites I trust.

I have a portable hotspot so I never have to use public wifi. I also clear my cookies after every browsing session. I believe I use a setting on Firefox that does

It automatically for me upon exiting the program.

Change passwords often. Even rotating between 5 or 10 similar passwords can be effective!!

I don’t let my kids download music or apps on their iPods without me approving it. They don’t know the password so I have to put it in for them.

I use paypal for online purchases whenever possible to avoid sharing my bank or credit card information.

When keeping my information secure I always read and subscribe to tech notes, updates on privacy settings and do research on rumored settings changes. Always googling my self monthly.

i don’t share anything online that i don’t want everyone and anyone to know. and i only use our online banking and sites like that at home.

Google alerts. Also, I like to have an email address with my real name; but I don’t want to hand that out when I’m making a Craigs list or Freecycle request, so I have a second email address that gets forwarded to my regular account.

I am really consistent with my online banking and purchasing. I use the same card for everything so I don’t lose track of what’s going on.

This is an oldie but a goodie – don’t click on ebay or paypal (or bank) links in emails when they’re telling you something is wrong with your account. ALWAYS enter the link by hand, otherwise you’re bound to get sent to a phishing website. I can’t tell you how many times my mom’s ebay account has been “hacked” and I KNOW it’s because she falls for those emails.

Keep your anti virus software up to date. It will protect you against the latest attacks.

I have Google Alerts set up on my name, my husband’s name, and my daughter’s name (in addition to other things of interest). It’s an easy and automatic way to be alerted to ALL kinds of things!

I use a fake name on facebook: Mack Daniels. As if that’s a real person.

I have lots of suggestions! I opt out of automatic location tagging on my smartphone. I stopped using Foursquare and other location-based apps when I’m with my children. I remove landmarks from my blog photos- even the less obvious ones like trees. I rarely share photos on Flickr.

I have email alerts set up through my bank and credit card company–anytime a purchase over $75 is made, I receive an email. Keeps me in check with my family’s purchases AND alerts me if someone steals my card.

I have a couple friends who work in IT so I pick their brains about what the best way to protect my computer is. It’s a great chance to catch up with good friends and learn something at the same time!

iAwesome! We have WiFi in our house, and it’s password protected.

Use a nickname on Facebook. That way, you can pick and choose who you want to befriend and who you want to know you’re on FB.

Also, be vigilant as to who tags you in photos. You can untag yourself.

Be careful not to let details about your daily routine seep into your Twitter and Facebook statuses…

Use paypal, secure wifi, and an obscure email address for transactions. And never check the “remember personal info?” box. 🙂

Great tips posted. My FB account was hacked, and it was pretty scary. Have different passwords for FB and email address associated with FB.

I teach my 5 year old that Facebook, emailing & texting are ways to communicate with people. Developmentally he can’t really grasp that there’s a conversation going on so I read him some replies I get so he has a clearer sense that there’s another person involved in social media & electronic communication.

Never check remember me as I had my computer

Stolen and all my bank and credit cards were then accessed.

Scary!!

I regular check and change all the passwords for each member in the house. I alone am administrator for all accounts. Each person is notified of changes. This helps me to be able to monitor the children’s accounts and to keep control over who has access to our information.

Hope this helps someone! Plus I found some great tips by reading through these comments.

I recently learned a big no-no when my boyfriend’s gmail account was hacked and the hackers got into his credit cards and bank accounts since the idiot(I say lovingly)had all account information saved in gmail notes since he can’t remember numbers to save his life. The lesson? Info saved on the internet isn’t safe. Don’t do it. 😉

We check our bank accounts frequently to keep an eye out for fraudulent charges. Oftentimes crooks will charge a tiny amount to test if the account is valid, and then make bigger charges once the first one goes through.

Consider using roboform or another program that generates really difficult passwords and saves the passwords for you! topgun34er(at)hotmail(dot)com

Biggest safety feature I use: simply never letting a windows computer into my house. (not just shameful brown-nosing for the ipad, i promise!) Windows, and internet explorer in particular, is a hacker’s playground. Use a mac if you have one, and download firefox or chrome to your windows computer for extra protection.

make sure to password your wifi

I love using paypal!

I change up my passwords frequently — I keep a list of them in hard copy (several lists, actually) to keep track.

Truly, it was when I read that you should use a secure line when possible when you are on facebook.

Invest in a good antivirus program and KEEP IT UPDATED.

Tip: check your credit card statements- we were hacked and apparently signed up for a porno site featuring homeless people. And it took a long time before I queried the innoculous-looking charge on our credit card statement. NOT good.

Don’t post pics of the kids online. Also, don’t fill out quizzes and tests on facebook. Have you noticed how they always ask questions that end up getting used as security questions when you are setting up bank accounts, etc. online?!

i recently read a great article on my local news app about privacy settings on facebook. I immediately checked it out and changed a few more things to be a lot more secure.

I really like your cookies tip, too. I’m going to look into that as well. Thanks for the opportunity!

Cnet has some really valuable videos on security using public wifi spots

Karen

akjetmom@gci.net

Common sense, really, if it doesn’t feel right or seems too good to be true avoid at all costs. Works in everyday life on for internetvlife too!

I am pretty careful re: location based social media.. I also check my FB settings often.

I also have a ton of email addresses, only close friends and family are given my personal one, and I use different ones for different online activities (shopping, banking, etc).

We share two computers, set up in a public area of our home, for the family. My tip is, no computers in the kids’ rooms – so they can’t do anything online they won’t do in front of their whole family. Cuts down on the ‘Chat Roulette’ experimentation!

I suggest you check your phone settings. My husband showed me today a feature I was totally unaware of. My iPhone has a “location services” setting which allows your phone to pin point where you are at any exact moment. It’s typically used with apps that search for local restaurants, parks, malls, etc. Well, if you have it “on” for your iPhone camera and you upload a photo to a website or social networking site, any computer savvy person can find out when you took the picture and exactly where it was taken. They can pin point exactly where you are! Scary huh? So my suggestion is to turn the location services to “off” for your camera on your iPhones!

Checking my bank accounts online daily. Using PayPal when I can. Protecting our wireless network at home with a password. And wow, reading the comments left here has been wonderfully informative!

I use a fake birthdate online, whenever I have to register for something, and on Facebook and other social apps – many financial accounts rely on client birthdates as a way of verifying information, and this way, I am not broadcasting that info. Plus, I ‘accidentally’ shaved 6 years off of my age with my new birth date, so really – a win-win situation!

I like to use Google checkout or PayPal whenever possible so I don’t have my info all over the place.

I also like to use my bank for all online payments instead of each one separately threw it’s own site.

CNET.com has been a great resource for doublechecking facts, options, and trusted sites. Also, excellent reviews and ideas for staying safe online.

I avoid giving too much personal information away on Facebook, e.g., I don’t give my current location, I only upload older photos or far away shots of my daughter.

Also, I try to be very careful about the usernames I select for websites, blogs and forums that I visit. I’m trying to remain somewhat anonymous in this increasingly small digital world.

My wifi is password protected and I delete cookies and temprary files at least twice a week

Use caps symbols and numbers for your passwords

I don’t keep my credit cards on file at any sites and just retype each time I purchase!!!

Make sure you check privacy settings on Facebook a few times a month to make sure nothing changes. Also I like to use different email addresses to separate personal and commercial emails.

For the kids, we set a login just for them that’s only able to access certain sites (they’re little now, so places like pbs.org, etc.). That way, if we step out, we know they’re not accidentally “wandering” where they shouldn’t.

I use a separate email address for all online shopping, memberships, etc. than I do for all personal email. I also use lots of weird characters in my passwords. And I invested in some really good anti-virus software and ask my friends in IT to keep me posted regularly.

I try to use only one credit card so that I’m not putting all of them at risk with the info out there.

I always look for the little “lock” at the bottom of the screen or the “https” in the web address to make sure that the site I’m on in secure.

Using unique passwords for each site I use. It may be ‘easier’ to have one password for everything, but it’s also much riskier.

I always ensure that I am using a secure site (https) when I am making any purchases online.

I use Paypal on all purchases that have it as a payment option. It limits my having to enter all of my credit card info on many different sites as well as limiting using passwords that I may forget or that may make it easier for people to figure out my passwords for different accounts.

keep the internet out in the open- none in the kids or your room where everyone can see what is going on

Avoid accessing personal or private information such as e-mail on a public computer (i.e. work, school, library, etc.) because there is no guarantee that this information is not tracked, and you’re probably not on a secure connection.

Periodically dump that cache & history. And I don’t announce my whereabouts on social networking sites as I don’t want folks watching my moves or loading up my house. Yikes!

Best tip yet? Reading all these comments for both a humbling reminder of the need for security and motivation to make a few adjustments!

iPad2? Yes, please!

I dont share where im going just where i have been. It’s stupid to share youll be gone for two weeks on vacation. You never know who’s reading.

Not only using unique passwords, but making my passwords different and not all the same has worked for me. That way if someone gets my email password they can’t also access my bank/fb/etc.

when making purchases online, i use the specially generated one-time use credit card number

Everyone has given such great tips already!!! My only addition is that I only let my little one play games on kids sites that don’t let you visit any other urls. And on my phone any app she plays with also has a child lock so she can’t do anything but play the game.

A high school vice principal, I am developing questions teens can ask themselves before pushing “send”: Am I publicly expressing a feeling better conveyed privately?

I’ve made a rule that I won’t say anything about my kids online that I wouldn’t say out loud to a friend when they’re sitting next to me.

Make sure site is secured (https) when putting in financial info And change important passwords often.

The Kids’ PC from Toshiba- that has kidzui on it! Kidzui just seems great! (My kids are still just a little too little to have their own computer just yet, but almost!)

Make sure to have unique passwords for all your accounts. No recycling the passwords. The only time recycling is bad.

Unfortunately, we’re trying to get my mom out of a major scam right now, so I know more than I ever thought I would. The IC3 website (Internet Crime Complaint Center – IC3.gov) has great links to help identify common fraud schemes and how to protect yourself and your loved ones! Please be safe out there and thanks for the contest!

I have a credit card where I can create a Virtual Account Number that can only be used one time. I don’t worry about having my credit card stolen online anymore.

I use norton websafe that checks the pages and if it’s not safe (red flash) I will not go to that site. It prevents you to go.

I recommend intermittently clearing your history so you don’t leave a clear path to all your favorite websites, especially if you on-line shop a lot.

I rarely allow my kids online … and only for a specific reason and when I’m in the same room.

I’m so diligent about never using my kids’ actual names online that some of my Facebook friends don’t know what their names actually are! I have deleted comments in which people have used their names and I don’t post pictures if their name is in the picture (like on a piece of artwork they did in school.) They’re going to have enough privacy concerns when they’re older, so all the better if I can keep their identities off the Internet as long as possible…

I use my ISP provider email only for family, friends and financial matters like banks and credit card accounts. It is more heavily secured. I use online type email accounts for other things like forums and gaming sites.

dchrisg3 @ gmail . com

I have a standard password for my blog stuff that is 100% removed from my personal banking/finance passwords.

Just in case.

Overwrite the hard drive of any old computer you are

donating or recycling and never store credit card or social security numbers on mobile devices.

I change my passwords on a regular basis.

I password protect our Internet at home. And secured our network. This has helped us minimize shady activity. Keeping my fingers X’ed for the ipad 🙂

I use an automated form filler so I’m not keying in my user name and password each time I access a site. The form filler will also generate a unique password for me that will also help protect my information.

I clear out all mycookies and cash regularly and I have a setting on facebook enablednthat I have to type in the name of the device I’m logging onto facebook with that way I know it’s only me accessing it.

Don’t save account information on websites. As nice and easy as it is, even safe sites can get hacked.

I get a lot of spam emails and I consider several things before even opening:

1.Have I contacted this person first?

2.Does it seem odd?

3.If it is a real person or company you can visit or call them directly to find out what the issue is without opening that email.

I always look for the padlock, to make sure a site is secure, when shopping online.

Never click on links in emails to access your bank or credit card accounts. These are almost always phishing emails.

I recommend talking to kids early and often about Internet safety! Even my 6 year old knows the basics. For older kids, I think it’s reasonable to ask for log in info and access to profiles on FB etc.

I use paypal whenever possible and always make sure the site is secure (https) whenever I am entering payment information.

When buying anything online, I try and use paypal if available–I was burned once on Ebay using my credit card–never again.

unique passwords! had 2 learn that 1 the hard way!

Making sure your software is up to date is a good way to protect from viruses.

I customize my Facebook privacy settings based on how I know people, and use two separate email accounts: one for people I actually know and one for anything done online. Lots of great ideas here!

my password is very unique

I use paypal whenever possible.

I always check to see if the website address begins with http or https. I f there is an s at the end then it is a secure sight. No s not secure.

I use Paypal whenever possible to help protect my credit/debit card info and I only pay bills online when at home.

I use paypal as much as possible and end up reading privacy tips for Facebook from friends when they update them in their status!

I try to stay up to date with popular websites and we’ll keep the kids’ computer in a public area.

I have a password on my home wifi, and a password protected guest account as well

Hello, for internet saftey and privacy when a blog such as this wants my email address in the comment, I always format with an (at) and a (dot) instead of writing the authentic address in case there is a phishing bot somewhere. Thanks for a great giveaway!

I always check the url before paying for anything online – make sure of the lock and only use trusted websites

What are the “security” questions” you get asked for internet banking and bill pay, in case you forget your password? Usually things like “Street you were born on” “Name of family pet”. The same questions get asked during those “How Much Do You Really Know Me” games played through e-mail forwards and Facebook Notes. When hacked, the identity thief is only a step away from gaining access to your financial information!

I have 2, actually. 1: Use a credit card or paypal when buying online instead of a debit card. Credit cards usually have fraud protection whereas debit card do not. 2: Always be wary when something has a link attached that you have to click on. Even if it comes from a trusted source. If you have any doubt, don’t click on it. You can always ask the person before checking out what they sent and it will save you from phishing scams and viruses.

I use a “fake” email account for non-essential online transactions. Thus, if that one is hacked. I do not need to be as concerned about personal information being compromised.

topgun34er(at)hotmail(dot)com

i make sure my child is in the room with me when hes on the internet.

I love Pay Pal. If a site doesn’t offer it as a payment method I don’t buy from them online.

Leave your birthday off of facebook and other public places! It might be fun to get all those happy birthday messages, but you are also giving away a key bit of information about yourself to pretty much everyone.

frequently change your passwords!!

I like using Avast security and Adaware for malware. thank you!

We have one credit card that we use for online payments and nothing else. It’s also the card Paypal is linked to. If it’s ever compromised, our checking account is safe.

My debit card number was skimmed at an ATM once and before we discovered how it happened, the bank suggested that it could have been from using it online. Nope, not possible. It’s a good way to keep track of things.

fav tip: use decent passwords. As much as that’s an old one, people still don’t make decent passwords.

Check your bank accounts daily!

I block certain sites so my kids can’t go there.I also keep a watch on what they are doing when they are online.

Thanks for the giveaway:)

Set all privacy settings to “friends only” on facebook. I never take those surveys or play those games either that can take all your personal information.

I use a password that’s somewhat complex; meaningful to me, but no one else.

We keep our Picasa albums private so you have to have a link to that specific album. Now only the family and friends we send it to can see our munchkins.

Zab Browser is a great browser you can install on your computer so your young child cannot nagigate to inappropriate websites.

mscoffee77(AT)juno(DOT)com

Password protect your home WiFi! Can’t believe how many open networks I see when I log on!

While I think it’s convenient and easier I try not limit the place I “save” my password and log in information. This can help prevent chances of my private data and info being accessed.

From time to time, check on the privacy settings on Facebook. Always a good tip.

Keeping my son’s computer where I can see what he’s doing takes a lot off my mind, too. Also, I make sure he understands about internet safety regarding instant messages, etc.

lots of good tips!! My advise is to keep reading. There’s always something new out there… be aware.

Have a good firewall and virus protection software. There are some free options that are great!

I saw some tips about keeping one password so you can remember. I have a set of passwords I use. one for my very sensitive data (banking, etc) one for mid-tier data, and one used for the 3000 websites I’m enrolled in.

ipad yay!

I switched mine (and my husband’s) Facebook accounts over to the new https option. If my kids were on FB, I would probably monitor their security settings for them, because there is too much ‘drift’ in their policies, and I doubt many kids know about the https option.

I use my nickname on everything instead of my actual name.

I have sets of ‘fake’ answers to the password-prompt questions that sites require, because it takes very little to reset someone’s password. Sometimes all it takes is knowing where they went on a honeymoon, or their dog’s name! So when I set a password for something, I also set fake password prompts. Nobody needs to know my mother’s real maiden name!

I never use my debit card online or anywhere where it might be out of my sight

Use capital letters and numbers when creating a password to make them harder to guess.

I teach Digital Safety to my 7th graders in computer class. You’d be frightened at how little they are aware and how many of them have Facebook accounts (even though legally they aren’t supposed to have one until 13!) There are a lot of great resources to use with your kids like netsmartz.org or Common Sense Media. I think the most important thing is to keep the family “computer” (be it a laptop, iPad, desktop) somewhere public where you can monitor what your kids are using, and TALK TO YOUR KIDS about what is and isn’t appropriate. Don’t use the tech as a babysitter, but as a tool to let them interact.

Never have my browsers remember usernames and passwords for banking sites or paypal.

We have our WiFi password protected.

Before sending or forwarding any emails, I check snopes.com. Also, I have a great anti-spyware program on my computer.

Change your passwords every other month

A simple tip, but one I know a lot people don’t follow: do not open attachments in chain emails! I know people who not only open every single attachment or click on every link, but they also forward them along, too. Just because the email was sent to you by someone you know, doesn’t mean it is safe to open!

Make sure any site you provide your credit card is secure (look for lock on your bowser screen).

Set your Facebook setting to view on secure site

Use a one time virtual credit card number when shopping online.

I am always deleting cookies, browsing and tracking info. I never use public wifi to purchase anything or access my accounts.

I do check my Facebook settings every so often – thankfully, I don’t usually find anything, but I have been surprised a couple of times.

never click on a link in an email. Go directly to the site, and put in your info.

itsjustme62613 at gmail.com

The best way to check your Facebook settings is to log out of Facebook, and then go to your profile. That way you can see what is available on your profile to people who aren’t your friend.

Use a password phrase instead of a real word. Much harder for an identity theif to crack.

we password protect our wifi at home

I use complicated passwords and Paypal!

Since our kids are skill young, we make sure they know that an adult has to be present to play on the computer.

I stopped posting information about our upcoming trips on Facebook. Before, I would do a countdown and talk about how excited I was. Now, I post about how great the trip was, after the fact.

(*crossing fingers for the iPad*)

One tip that has helped me greatly is to not click on links in an an email. It’s better to type in the website and go from there.

don’t click on unknown links in email

ardy22 at earthlink dot net

I use paypal instead of my debit card online. I also don’t have a cc so that nothing to get compromised there.

I set my privacy settings high on Facebook so that only my friends can see my pictures that I post of my children.

I only have one card I use online. Its a credit card and not a debit card or linked to any bank account.

I also have an email account that is solely used for online purchases, never personal correspondence. That way, I never miss an important email!

While on Facebook, look at your URL address; if you see http: instead of https: then you don’t have a secure session and can be hacked. Go to Account|Account Settings|Account Security and click Change. Check at least the first setting. Click on “Browse Facebook on a secure connection (https) whenever possible.” FB defaults to the non-secure setting.

I know it’s all the rage, but I refuse to “check in” anywhere on Twitter or Facebook. I do not like anyone having that much access to my whereabouts.

Resist using features like four squared that broadcast your location to all!

Change passwords regularly and don’t pick obvious ones like birthdays!

def. wifi password protected,only browse secure website and dont let computer remember passwords.

use the maximum number of characters allowed for a password. the longer the password, the harder it is to try and hack it!

do not email sensitive information. this is not a secure way of transferring visa numbers, etc.

1) Password access on all devices – phone, iPad, laptop, etc.

2) If you do any kind of confidential work or have confidential client information on your laptop, invest in laptop encryption software so that if it is lost or stolen, you haven’t also compromised all that information.

I listen to Cnet Buzz out Loud for the low down on the most recent privacy changes on Facebook and any cyber threats going around.

Definitely password-protect your home

Wifi, and don’t open ANY attachments unless you’re 1000% sure of exactly what they are.

My new rule is: Do Not Share Personal Info on Media Sites (facebook, twitter, blogs, discussion forums, etc.)

This includes not posting your child’s real name.

Use different passwords for financial sites than your shopping/fun sites.

Turn on cookie notices in your Web browser, and/or use cookie management software. Alsi I use Paypal 🙂

Don’t use any identifing info in screen names. Ie: hsvcharger99. Someone can figure out that is a team name & plater#.

Would it be tacky to say that I follow Cool Mom Tech and keep apprised of the latest and greatest? Also, approach every request for information online as I would in person, do I really trust this person/company with this information?

We use websites that do a lot of business online and limit where our info is stored.

I only use my home computer for bank transactions and making online payments. It is safer than a mobile phone device because mobile phones can be hacked on more levels than your computer.

The computer is in the kitchen, so I always know what my kids are doing online. And they know never to fill in any forms themselves.

And I’ve also learned by screwing up: Our credit card was stolen after I made a purchase using public wifi just last week. What on earth was I thinking?

One way fraudsters can use to access your personal information is through malware that might infect your computer. To prevent such infections, it’s ‘very important’ to keep your operating system and web browser up-to-date! It’s also important for you to update and run your anti-virus soft-ware on a regular basis!

I found very helpful security information over at http://www.lifehacker.com

They had a breach of security and devoted several posts about the best of the best.

Thank you and have a great day!

I never give information that is optional. Also, when you are at stores shopping in real life, you do not need to give them your phone number, zip code, or email, no matter what they tell you. Just say no!

I use Lifelock and it monitors my credit and sends me email updates about any changes to my credit (if someone tries to open a credit card etc).

Paypal is awesome for safer online purchases. Plus, it keeps my spending in check :o)

Have a strong password.

I work for a bank and I use our password policy for my own passwords. Unique, not found in a dictionary and a combo on letters, symbols and numbers. And I change them every 90 days

I don’t put letters in my mailbox. I bring them to work to be picked up to be more secure. I do a lot of online transactions and try to use sites that are secure.

Avoid those “Get to Know You” memes that ask the same types of questions as password-unlocking security questions on websites!

I learned to have a good virus protection and keep only friends on places like facebook.

Above all else, use common sense. Just because the internet is cool and useful doesn’t mean you should disengage your brain.

never post your social security number online

I change passwords frequently on my heavily loaded with info sites

Microsoft.com has some great advice for privacy and security.

Also, we tell our kids that any device that we give them is a family device set aside for their use. As long as it is a family device, we have the right to check it at any time and we will pay for its use. It’s a privilege, not a right.

We also make sure that our network is secure and current with anti-virus software.

I routinely change my passwords to things not every crazy ex boyfriend knows about.

I try to use paypal where ever I can!

I always use passwords containing at least one capital letter and 2 numbers.

Change your passwords frequently and use “stong” passwords (ie letters and digits)

I don’t put personal information on facebook like going out of town or anything because you never know who may want to do you harm.

As a teacher, my advice is to preview websites before your child does any “research” for school projects or papers. I’ve seen some unbelievable things pop up in the school library and computer lab just from 2nd graders searching “white house” or “mammals.” Find the “kid-friendly” search engines and use those instead of the big name ones!

I am always on my go and use my iphone often to shop online, pay bills, facebook…but I never use wi-fi. I always use my 3g.

Always read a websites policy before giving out any information. Also make sure the website is secure.

Dove056 at aol dot com

Don’t let anyone use your smart phone cause they might get into your personal accounts and info.

log off of all sites once done

Try to remember to check my credit each year to make sure no strange activity is in there!

Whenever I go to social websites, I always set my account to private so nobody besides my friends can see my information.

Never post personal information online on blogs.

I do not like to use my cel phone as a contact number online. Just use my landline phone for more privacy.

Use different passwords!

So many people leave their home wifi unprotected! Use a password folks!!

I keep up to date on privacy issues by constantly Googling and reading. #1 issue: If you wouldn’t tell a stranger on the street your child’s name and where you live, then you need to have due diligence on protecting that same info online. Watch your settings – including photos. My Flick account is set to private, my FB photos are set to private and I password protect elsewhere.

We keep out computer right in the living room. That way everyone knows what each other is looking at. Keeps us all involved.

Password protect your home network.

I try not to use the same passwords for everything. I also try to change them every once in awhile

I make sure to change my passwords often.

Change passwords often. Use a different email account for financial transactions than you do for anything else. Don’t use obvious passwords like your child’s name, your birthdate, etc.

Always, ALWAYS assume anything you do online could be seen by anyone, including criminals. Keep that thought when you’re using facebook, blogging, chatting or using any messenger-type service, especially. People let slip information about their neighborhood, their kid’s schools and after-school activities, where they bank, etc. All within conversations they have with others online.

I use separate email addresses to filter my mail and I only post pictures of my kids on my personal Facebook profile–not on my blog or blog’s ‘like’ page!

I really don’t have an issue with internet privacy. I enter alot of sweepstakes and (knock on wood) haven’t had any issues. My husband also keeps my security programs well updated.

I am vigilant about checking my Facebook privacy settings!

I always pay with Paypal when available. I also pay with a credit card that will reimburse me in case of identity theft. I always make sure that I am purchasing from a secure site.

I always keep the computer in the kitchen where I can see what my kids are doing online and the kids use KIDZUI to play games on the web that way all the games and videos are kid appropriate. I never let them on YouTube unless closely supervised.

We only use a CC for online shopping, in case the information is stolen it’s not connected directly to our bank account.

Log off of all sites once done

nickieisis3atgmaildotcom

All computer use must happen in the main living area of the house. I also removed You Tube and other apps from my sons Itouch to prevent and accidental clicks.

I only use my Amex for online purchases and a seperate email address(not associated with my Internet carrier ie.hotmail,gmail,yahoo) for all online registrations.

I pay most of my bills online. After entering a payment and logging out, I always close the brower and open a new one before moving on to the next website. I also never save any of my passwords in my autofill program

My kids are still young but I think modeling is key so I keep our internet profiles anonymous or with fake names and hometowns and set the privacy settings the way we like them…hopefully this mindset of knowing just bc it’s just a screen doesn’t mean you’re safe wears off on them!

I make it a point to talk to my kids about news stories pop up about cyber bullying, sexting and other tech issues that can affect tweens and teens. My oldest is in middle school and I want my kids to be tech savvy yet street smart about the dangers and pitfalls of technology.

I like to make up a fake name that is similar to my real name. I totally confuses my facebook friends!

Dont open suspect emails

We only allow the computer in the family room, so that we know what is going on.

Keep the computer in the main family area, not bedrooms. Kids know mom is around!

don’t use the same password, and change them every so often, especially if you think your security might be compromised.

I agree with many of the other comments that Facebook privacy settings (set them–do it!!) are amazing. I also tend to use Firefox for my primary web-browser and it allows for private browsing very easily (no cache, cookies, etc.) which I like for my work machine and any other shared terminals. I also think it’s a good idea to lock down passwords on any mobile dvices you use when you can (many apps offer it).

On FB, I don’t announce that we’re going on vacation so that the world knows (including the robbers)!!!

I also use paypal whenever possible – I will even pay a dollar or so more if the site offers paypal use!

I used to have very generic passwords, but after my husband’s email got hacked twice I’ve made them way more cryptic; my husband has taken to using an online random generator to come up with his now!

Change passwordonce a while. I change it every month! It helps!

Add “betterprivacy” firefox addon to your firefox browser to keep the newer hard to control SUPER- cookies at bay.

Paypal whenever possible!

In order to avoid having my account hacked, I no longer accept any third-party application requests inside of Facebook.

Never post you are on vacation on a social media site. It tells enshrined you are gone and leaves your home vulnerable to intruders!

I have password procteted my family blog before. I make sure nothing I post will end up in a google search result (this is a blog setting), and still make sure I don’t post anything too personal or that would identify where we live. And keep those cute bathtime pics off anything internet-related.

We are very careful about the things are kid are exposed to. Now that we use Netflix with the Wii, I long for a parental control option for the “browse” feature on this. I hope they’ll add this soon.

Setting your home wifi to private is also important

My favorite online security tip is to do this;

If your going to buy a larger ticket item or do large amount of online shopping, buy a reloadable debit card. You can buy them at any Walgreens or Rite Aid. Then if the card becomes compromised you wont have to worry about closing all your accounts at the bank.

You simply close the debit card. And your info is safe and you wont have to worry about being without your debit card until the bank ships you one.

Passwords with numbers and caps.

I use Paypal whenever possible. I like the extra protection it offers me and I don’t feel as worried about getting scammed.

I have my browser set to not keep a history log and delete cookies so as to avoid potential browser hijacking. I also, like many, use Paypal for online purchases and research businesses through the BBB.

The computer is in the family room. That way I can sit w/my kids during use. Also I like to discuss with them the good the bad and the ugly about what’s out there on the WWW. Open communication is always a good thing!!

Use different email addresses / usernames / passwords for different activities online – we all use the same for everything, with slight variations. Go with something totally random for all financial sites, so if someone hacks your social networks and email, they won’t have an easy place to start guessing your logins for more important stuff.

My favorite safety tool is spectorsoft (https://www.spectorsoft.com/). When I had a teenager in the house, it was loaded on the desktop. She knew it was there. It provided wonderful reporting if she visited certain sites, if certain words were used in email and chat – recorded everything. I loved it.

With my other children swiftly approaching the teen years, this will get loaded on all of our computers.

I don’t allow my husband to use the internet.

Monitor and discuss with your children early and often.

I have locations turned off on my phone for photos so others cannot see where my pictures were taken. ie. what park my kids play at.

What I don’t understand is why would people have over 300 friends on FB? Do they really keep in touch with all of them? That’s safety #1 in my book. All those people know where you are, have been, or are doing.

I never submit my birthdays or SS# to any websites that need it.

Our computer is in a central location so we can watch what our kids are viewing and our WiFi is password protected.

Always assume that everyone in the whole wide world will read what you post … And see what you post.

Only accept friends I know. Keep my privacy settings to friends and only refer to my child with an initial in public postings.

I make different random passwords with a mix of letters, numbers, upper and lower case for each financial site I use and change them regularly.

I think it can be really hard to find the balance between what to share and what to keep private. With kids, I think the more settings and information remain private, the better. I don’t use my kids’ real names online and keep all setting as private as possible on places like Facebook.

I update my passwords quarterly and don’t use easy things like my date of birth or daughter’s name. The tricky part is remembering them!

I especially check facebook privacy settings when putting up my photo albums of my kids. I only want my friends to see those pics, not everyone on facebook.

I set my email settings to only allow emails from my contacts to go into my inbox, so all spam and any other weird emails go directly into my junk email folder. This makes sure that I don’t accidentally open any email that contains a virus or anything else that could harm my computer and personal info. I do skim through my junk folder periodically to make sure an email of someone I know did not get put there, and if it did, then I just add them to my contact list so it doesn’t happen again.

I didn’t realize you can enable cookie alerts through your browser. Very helpful!

I didn’t realize you can enable cookie alerts through your browser. Very helpful!

Page froze & went blank, I refreshed and my comment was posted twice. Please delete the 2nd comment.

I would love to win an iPad!

I use PayPal whenever possible. I always use passwords with both letters and numbers. When my son is using the computer in my office I am either with him working in the room or I pop in randomly to see what he is doing. I ask questions about what he is doing as well, such as when a game involves chatting with other players. For extra security I enter each devices MAC address into my router to connect.

I don’t own any devices that use wifi away from my home so I don’t have that to worry about that yet.

An Internet rules contract, much like teachers have

at school is a good idea at home too. It’s a great

way to set expectations up front and consequences

too, and allows for discussion of Internet safety.

I use paypal for all my online transactions. I also check my facebook privacy settings pretty often. I change passwords on a regular basis and make sure that they are random.

I know everyone says this, but I am noticing as we become more attached to our mobile devices and tablets, it is easy to let your children slip into another room where they are not supervised. Always insist that Internet use is in an open area of the house.

Also, read the terms to accounts. Many of my students are signing up for google buzz accounts when the terms state they must be older than they are to have an account.

I do not use public wifi. Never did trust it.

I have set google alerts for my kids names.

I use random passwords that don’t mean anything for everything.

Password-protect your computer to prevent unauthorized access

I make sure our virus and firewall protection stay updated and run a scan everyday.

I feel safer using paypal

UseCommon sense.

Make sure your WiFi connection is secure.

I turn off my wi-fi when I’m not using my laptop.

A password doesn’t just have to be a single word. A phrase or short sentence is even better, while still using numbers, symbols, and mix of caps and lowercase.

Kid’s websites are notorious for spam and tracking and devices. I have taught my son not to click on advertising banners. I also run spyware / virus sweeps after he is done. It protects my privacy and keeps my computer running smoother.

Never give out personal information and always know what your children are doing and looking up on the internet. The internet can be a very good thing but also a very bad thing.

Don’t let websites autosave information. It means more typing when you come back, but it also means less chance of someone else getting your information.

Always use a “smart” password – include upper and lower case with a number and a special character.

I use Net nanny to keep questionable sites off my computer

Never allow your computer to make passwords appear automatically. They are then stored, and can therefore be found.

I change my password often and since every sight has their own password, that is confusing. I keep a small notebook just for passwords in another room. When I change passwords, I just cross it out and put a new one!

I have Facebook set so that whenever there is a logon to my account I get emailed, it makes me feel less likely to get hacked, even if that’s not really the case! 😉

Use Paypal for all on-line shopping, or at least whenever I can.

I use Paypal to pay for as much as I can when shopping on the internet. With paypal you purchase is always guaranteed and you don’t have to worry about the merchant seeing your financial information.

I use Paypal to pay for as much as I can when shopping on the internet. With paypal you purchase is always guaranteed and you don’t have to worry about the merchant seeing your financial information.

Do not make your passwords too easy to figure out. Use a combination of random numbers and letters, at least 5 characters or more. I know of someone that used 12345 as their password. Not a good choice.

Never click on ANY links, no matter who sends them to you.

We set all our browsers using Google’s Safe Search feature, so that kids looking for homework help can find what they need without running into adult content or images.

You have touched on so many of the tips I use:

Use your home computer for purchases

Clear out your cookies list periodically

Check your credit card statements

Buy from reputable vendors

Look for the s after http for security

I am hoping to learn from this series. Thank you!

We have a PC, and it allows you to create individual log-ins for each family member. That meant that we (the parents) could be administrators of the log-ins for kids – we can control what they can and cannot download, what programs they can access, and which web sites we can block. Having a log-in for each family member is a really powerful tool for controlling what they can, and cannot do online. So, for example, you can block Chat Roulette.

When shopping online if I plan on buying from a site I’m not familiar with I look it up on the Better Buisness Bureau’s website and search online for any complaints.

I use one credit card for all online transactions and keep a very close eye on those statements for fraudulent activity.

I make sure a site is https secure before giving out credit card information.

Our home wifi is password protected. Very important.

Generally, it’s best to share as little personal information as possible online. However, if you need to give out sensitive information like your credit card number and/or home address, it’s ‘always’ best to verify that the recipient of the information is ‘trustworthy’! This can easily be done by checking reviews of unfamiliar websites before entering personal information and allows you to see if others have reported issues such as ‘phishing’!

Make sure when you are doing any online commerce that you are using a secure site, indicated by https at the beginning of the site’s URL.

We have decided to use one Debit card for online purchases. we go one of those prepaid cards and add to it when we need to make an online purchase. I don’t want my bank debit info out there.

One thing I do when I’m shopping is make sure in the address bar there is the “https” instead of just the “http”. That “s” stands for security. Thanks again for a wonderful giveaway!

yes i also use paypay if availablr for payments online..except for itunes..people been hacked from that source..beware

Switching to paperless statements not only saves us $$ with stamps, but keeps the paper trail of our info to a minimum!!!!!!

I never submit my correct birthdate information when registering at websites. Month, date, year are off by 1 so that it’s somewhat reflective of who I am for their survey purposes, but never accurate enough to be correct for security purposes.

paypall all the way!

Have a strong password of letters and numbers.

After reading all these comments, everyone has posted my usual security checks. But just a quick thank you for all the new ideas posted!

I got a prepaid credit card which I have a portion of my paycheck direct deposited on. I use this card to buy things online, so if it were to ever fall prey to identity theft it isn’t linked to my bank account and only has the limited small funds each month, plus it has it’s own fraud safeguards. I think it’s one of the smartest decisions I’ve made in regards to internet shopping and privacy control.

My kids LOVE to play games on the computer, so we had a “block” put on our pc that enables them to only go to “our approved” sites! No pop ups 🙂

I never use public computers at the library, hotels, etc to check my email, facebook or do online shopping. I also, never allow websites to save my credit card information for faster shopping the next time.

Paypal is great. I also have separate strong passwords for different uses and have a separate email address that I use for online transactions. There are so many good tips!

I definitely try to keep my passwords as unique as possible. We password protect our wifi and even just our computer. We are also pretty strict on our facebook pages with who can see what.

We make sure our virus software is up-to-date and we run Spybot Search and Destroy once a month. Security Tango is a great tool also.

check your statements! I have found an error more than once- once a purchase was made with transposed numbers, not theft so it can happen!

For me, it’s making sure you have a credit card that is just used on the internet and checking it often!

I use Paypal when possible to limit the number of times that I have to share my account info. My credit card also has a “virtual” account number that helps too!

never use your real name

ardy22 at earthlink dot net

My biggest resource in online safety is antivirus and anti malware programs. I update weekly and I scan weekly, because even I’ve almost clicked on bad popups, not realizing they were virus attempts. Thankfully my Norton saved me. But I don’t trust that my kids are aware of such things, so hopefully being vigilant about it will prevent any problems that could also breach our security.

Purchase a good filter for your computer so that one will not unwittingly find themselves on troublesome sites.

Dove056 at aol dot com

I have different user accounts set up on my laptop for each of my children (and my husband). I’ve set the security rights/Internet browsing options based on who’s account is being used. Each is password protected so they cannot be accessed by anyone else (except me 😉 )

I always look for the little lock in the lower right corner of my browser window before making an online purchase. Also, we have a password-protected wireless network at home.

Wow! Thanks for all these great suggestions. We do a handful of these, but there are a bunch of ideas on here I didn’t previously consider. I’m doing so much nowadays with my smartphone, including letting my kids play with it, that I’m realizing I need to set a password to mitigate some random surfing/purchasing, etc!

I always have my antivirus on whenever I am online. If I purchase items on the internet, I make sure it’s a secure transaction before I enter my personal information.

I like using Paypal in order to decrease the number of retailers that have access to my credit card info. I also never use a debit card online.

I prefer to shop on sites that allow me to use Paypal. This way I am not giving my financial information to every place I shop.

I always pay attention to my McAfee site advisor to make sure I am not surfing in unsafe cyberspace.

I use way more complicated passwords now, with numbers and letters mixed. Harder for me to remember sometimes, but also harder to hack!