Here are 3 things we suggest you do for minimizing the paper trail.

don’t already pay bills online, now is a good time to start!

You can set up automatic payments every month through your bank for fixed payments like your mortgage or insurance payments. Also,

set up e-billing with creditors like your utility company or phone service to

eliminate paper entirely. Ask for your monthly statements via

email and create an email folder (or desktop folder) to file all of

them if you’d like–though you should be able to access at least a year’s worth of bills directly through their websites.

You’ll notice a dramatic decrease in paper mail immediately, and

you’ll find you’re in way better shape to sort through it all come

April.

One other benefit: you’re less likely to miss payments. In fact one great tip with a credit card with a balance: set up an automatic payment each month of an amount that’s at least the minimum due. If you can pay more that month, go ahead and adjust it, but this way you’re guaranteed to make your payments on time and keep those interest rates low.

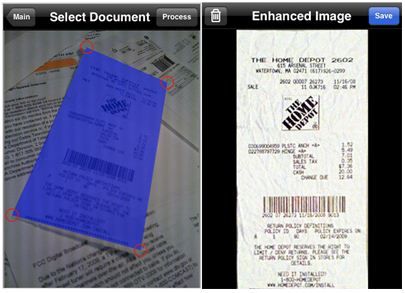

above) are two awesomely portable scanners we’ve covered in the past

that will let you instantly scan the bill and not only have them on

paper, but digitally as well. They scan everything from bills to

receipts, even artwork, to free up space in your filing cabinet, your

drawers, your fridge. You get the gist.

app lets you scan directly from your mobile phone without the

investment of a physical scanner. Simply take a photo of what you need

to scan and then you can immediately “file” it away (don’t you love the

cloud?) and even email or scan them directly from the app.

Once you have everything digitally stored,

it’s easy to shred and recycle all that paper that’s tucked away–and

remember, for tax purposes, you only need to save bills and receipts up

to 7 years. Enjoy those new empty shelves! -Jeana