To me, fall means organization. Not just around the house, but in a “let’s get it together” kind of way for everything in my life. One of the things I’m committed to is taking a better look at budgeting, how I’m spending money, and where I could be saving–especially as those college payments get closer by the minute. (Ack, can’t even think about that.) So I’m glad there’s an app that really, really helps.

The LearnVest app (iOS, Android evidently coming soon) has been around close to a year, and I’m finally getting around to using it. Turns out, it’s a super financial resource, and here’s why.

We called the LearnVest website one of 5 great financial resources for parents, and the app extends all that helpfulness to your mobile phone. Basically it’s comprised of three sections: A money center, which is the core of the app; articles from the LearnVest Site which I find incredibly smart and succinct;and then the option for a free financial consultation. (Which I suppose could lead to a long term financial consultant relationship, and probably how the app makes their money.)

Let’s stick with the money center for now, which is where the real magic happens.

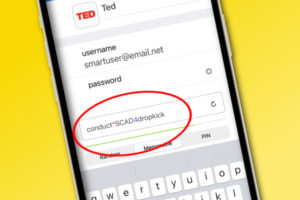

The first thing you’re going to have to do is enter the passwords and info for your various financial institutions so they can track spending automatically for you; fear not, it’s super safe and secure according to all sources, with bank level security. And there’s no way to actually access your accounts through the app at all.

In fact, I was really impressed how quickly it logs you out after inactivity; my iPhone went to sleep after a few seconds and I already had to enter a password to get back into the app.

Once you’ve entered your net income and monthly expenses, in a flash, you have a snapshot of your overall budget.

You can see whether you’ve taken out more cash at the ATM than you normally do, if you’re over or under on entertainment expenses or gifts, even factor in insurance and utilities. I’m delighted to know that I’m doing a good job on groceries–but kind of make up for it with restaurants. What can I say, I live in NY, where grabbing sushi is often cheaper than making it at home.

It’s also helpful to let you know you actually spend more each month on say, utilities, than you had been counting on. That way you can adjust that budget level and compensate somewhere else. Like shoes? Nah, not shoes.

The app really scores with really intuitive navigation, a very friendly feeling interface, and some incredibly smart features for those of us that don’t want to be accountants managing spreadsheets in our myriad spare time.

I like that charges are all put into folders, but you can also look at “unfoldered” charges–say the app doesn’t know what Fab.com means (ha)–so I can add that into shopping; or create a new folder, like tax deductions or work expenses. Or refile a “shopping” charge into “business and career,” should that Amazon charge be a new router for your home office. Another idea: separate out expenses just for the kids into their own folder, for after-school activities, tutoring, childcare and so on.

You can also add in cash transactions manually, because the success of the app really relies on you staying super up to date on every expense and deposit.

Now you may not have the energy or time to keep up with it non-stop. At minimum, it’s great for a month or two to help you get a handle on how you’re spending and saving. Or make good use of the savings goal feature, should you be working towards a specific goal like a kitchen renovation or stockpiling for holiday shopping now.

Download the free LearnVest app for iOS (we’ll let you know when the Android version is here) from iTunes.