Resolutions are a dime a dozen this time of year–lots of people make them and lots of people break them, myself included–but one of my ongoing resolutions (or let’s just call them goals), is to be organized with our finances and money management apps can help. Here are some of the best ones to help you keep track of the benjamins from day to day, month to month, or even in the long run.

LearnVest app

We discovered LearnVest last year and immediately took to its intuitive design. It comes with bank-level security, as any financial app that links to your accounts should, but so much more, too. What it’s most useful for is keeping track of your income and all your expenses and giving you a really good overview of how you’re spending in the app’s cool MoneyCenter. With categories, budgets, trackers and more that you can designate, LearnVest will help you achieve your financial goals. (iOS)

Mint App

As probably the most widely used and popular money management app, we have to include Mint on this list – and deservedly so. What’s great about Mint is that after connecting to your desired accounts, it automatically pulls in all of your expenses and categorizes them without you having to do anything. After assigning to categories, Mint creates graphs to show you where your money is going (may be time to ease off of those Nordstrom Rack visits) and even creates a personalized budget based on your spending habits. (iOS, Android, Kindle Fire, Windows)

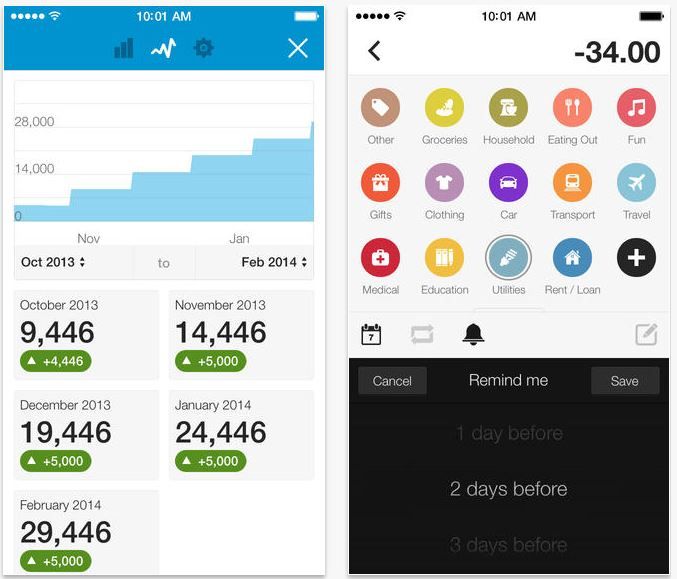

DollarBird App

Although it has a kind of goofy name, DollarBird is all business when it comes to your money. It’s another great app for tracking your expenses and overall budgeting purposes. Since DollarBird relies on you to input the information, it has been designed in calendar format to give you a day-by-day rundown of your expenses. You can of course get a broader picture, but the daily charges here and there can be a nice reminder that maybe you can make coffee at home instead of hitting Starbucks every day. I also like that you can set reminders for bills within the app so you never miss a payment. (iOS)

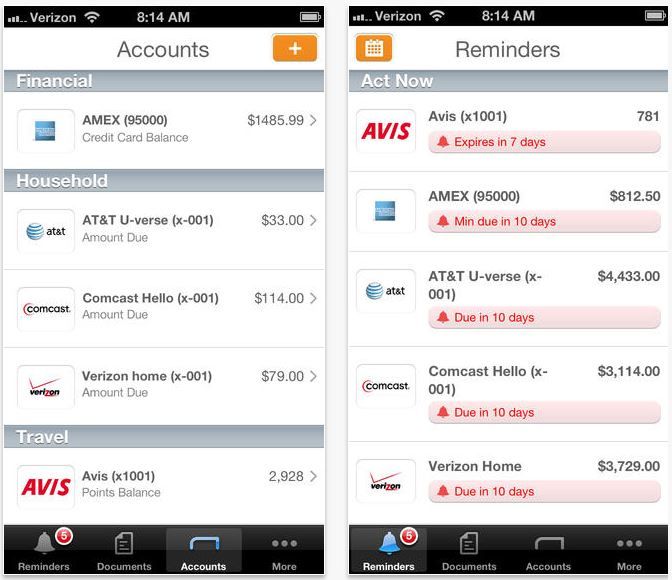

Manilla App

Manilla is another money management app you’ve probably heard of. It not only manages your finances, but acts like a digital reminder service for all your bills as well to help you go paper-free. While it takes a little bit of a commitment to set everything up and link to all your bills, travel rewards, subscriptions and more, once you do so, you can benefit from having instant access to everything at one glance. And making sure you are never late on your payments again. (iOS, Android, Kindle Fire)

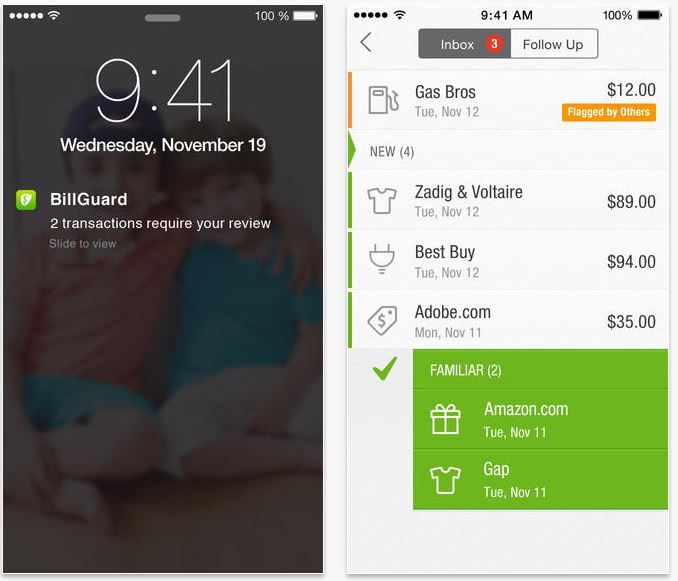

BillGuard App

BillGuard has money management and tracking features, similar to the apps listed above, but what differentiates it is a digital watchdog service for any potential red flags with credit card usage. Like if you make multiple charges to one place in one day, or spend a higher amount than normal. Using its network of BillGuard users, it also relies on crowdsourcing to flag suspicious auto-renewals, unapproved membership fees and hidden charges, also known as “grey charges” in the credit card industry. If you’ve ever been a victim of identity theft, then you know a service like this could save you a lot more than money. (iOS)

Manilla has closed it’s doors as of 1st July 2014.. I am very sad, because it was a brilliant app. Any suggestions for replacements?